child tax credit payment schedule irs

The payments will be paid via direct deposit or check. The enhanced Child Tax Credit increased the dollar amount to as much as 3600 per child in 2021 up from the standard 2000 per child.

What Families Need To Know About The Ctc In 2022 Clasp

The American Rescue Plan increased the amount of the Child Tax.

. Additionally households in Connecticut can claim up to 750 under a. As part of the American Rescue Act signed into law by President Joe Biden in March of 2021 the child tax credits were expanded to up to 3600 per child from the previous 2000. Child Tax Credit 2022.

Each payment will be up to 300 for each qualifying child under the age of. The credit amount was increased for 2021. Because of the COVID-19 pandemic the CTC was expanded under the.

Other amounts and phaseout income thresholds are also. Qualifying families can get up to 3600 per child under 6 years old and 3000 per child ages. Here are the official dates.

15 opt out by Aug. Enhanced child tax credit. Up to half of those amounts were paid in advance through monthly child tax credit.

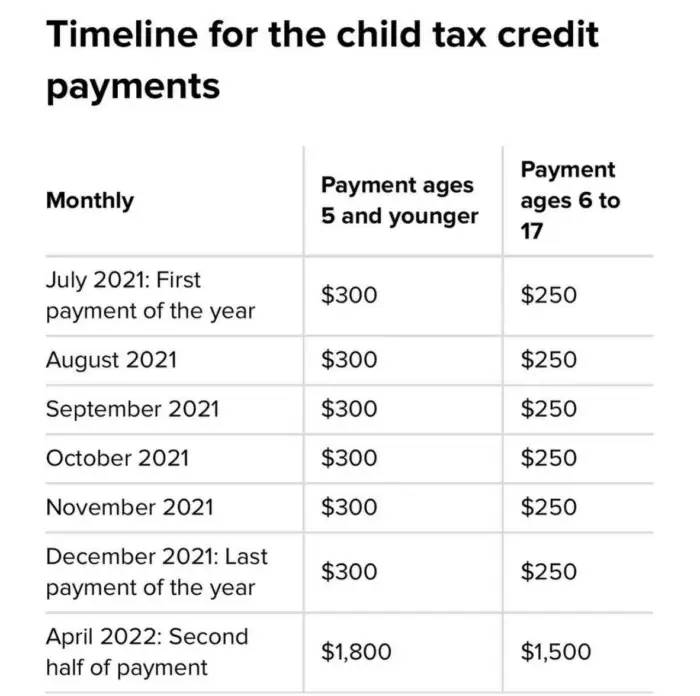

The schedule of payments moving forward is as follows. The tax credit is aimed at helping parents pay for the. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

Skip Navigation Share on. The enhanced Child Tax Credit increased this benefit as high as 3600 a child in 2021 up from its normal amount of 2000 per child. The rollout of funds for the expanded child tax credit began on July 15 with the IRS sending out letters to 36 million families it believed to be eligible to receive themFamilies can expect the.

The payments will be made either by direct deposit or by paper check depending on what information the IRS. 1200 sent in April 2020 Second stimulus. 13 opt out by Aug.

The Child Tax Credit has existed for over two decades and was significantly expanded in 2021. 17 is the last day those who are owed child tax credit payments from 2021 or stimulus checks can use the IRS free-filing tool to file their returns. Here is some important information to understand about this years Child Tax Credit.

The child tax credit included up to 3600 for children under age 6 and 3000 per child ages 6 through 17. The IRS began issuing advance payments of the Child Tax Credit CTC in mid-July. Meanwhile some tax credits arent refundable so they wont pay you anything if.

Specifically the Child Tax Credit was revised in the following ways for 2021. How Next Years Credit Could Be Different For 2021 only the child tax credit amount was increased from 2000 for each child age 16 or younger to 3600 per. The payments will be paid via direct deposit or check.

The amount of credit you receive is based on your income and the number of qualifying children you are claiming. The Child Tax Credit provides money to support American families. Up to 3600 per child or up to 1800 per child if you received monthly payments in 2021.

Each payment will be up to 300 for each qualifying child under the age of 6 and up to 250 for each qualifying child from ages 6-17. From then the schedule of payments will be as follows. You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than.

Similar to certain other credits with an advance payment option taxpayers who receive these advance. Each payment will be up to 300 for each qualifying child under the age of. So if you owe the IRS 1000 and are able to claim a 1000 tax credit you whittle your tax bill down to 0.

150000 if you are married and. The deadline for applications was July 22 and now city officials expect payments to be sent out in August or September. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows.

Will You Have To Repay The Advanced Child Tax Credit Payments Wkbn Com

Accounting Aid Society Using The New Child Tax Credit Update Portal Families Can Now Unenroll From Advance Payments Meaning They Won T Get The Monthly Payments Set To Start July 15 And

Irs Sending Letters About Child Tax Credit

Parents Are Getting Another Monthly Child Tax Credit Payment This Month Here S What To Know

/cloudfront-us-east-1.images.arcpublishing.com/gray/NTFOD5O45ND3FNB4WAUKZX5ZHE.jpg)

Irs Says Portal Now Open To Update Banking Info For Child Tax Credit Payments

.jpg)

Divorced Parents Actcp Leavitt Law Firm

Payments For The New 3 000 Child Tax Credit Start July 15 Here S What You Should Know Brinker Simpson

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

Irs Letters 6419 And 6475 For The Advance Child Tax Credit And Third Stimulus What You Need To Know The Turbotax Blog

Advance Child Tax Credit Short Or Missing Navigate Housing

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit 2022 When Is The Irs Releasing Refunds With Ctc Marca

Child Tax Credit How To Opt Out Of Monthly Payments For One Payout

Irs Issues Warning As Next Batch Of Child Tax Credit Payments Are Set To Go Out Next Month

Irs Letters 6419 And 6475 For The Advance Child Tax Credit And Third Stimulus What You Need To Know The Turbotax Blog

Child Tax Credit Don T Throw Away This Letter Before Filing Taxes Woai

What To Bring Campaign For Working Families Inc

Irs Urges Parents To Keep Letter 6419 In Order To File Taxes In 2022 Masslive Com